Investigation of Bibox exchange activities in relation to PLEX cryptocurrency trading: analysis and conclusions

2023-05-31

In mid-2022, the Bibox exchange came under the spotlight for suspicious transactions and serious allegations of likely bad behavior with PLEX tokens. In this review, we analyze how Mineplex, through its internal blockchain security protocols, uncovered these suspicious activities and what the consequences were for the company, its users, and users of the Bibox exchange. However, this is not an isolated case, CoinMarketCap, the world’s most popular crypto data provider has been receiving numerous feedback from customers about problems with withdrawals from the exchange. That’s why the site downgraded Bibox in the winter and issued a warning to users. “We have received reports from multiple users being unable to withdraw funds from this exchange. Please exercise caution while trading and always DYOR.”

Investigation of transactions originating from the exchange and their impact on the price of PLEX

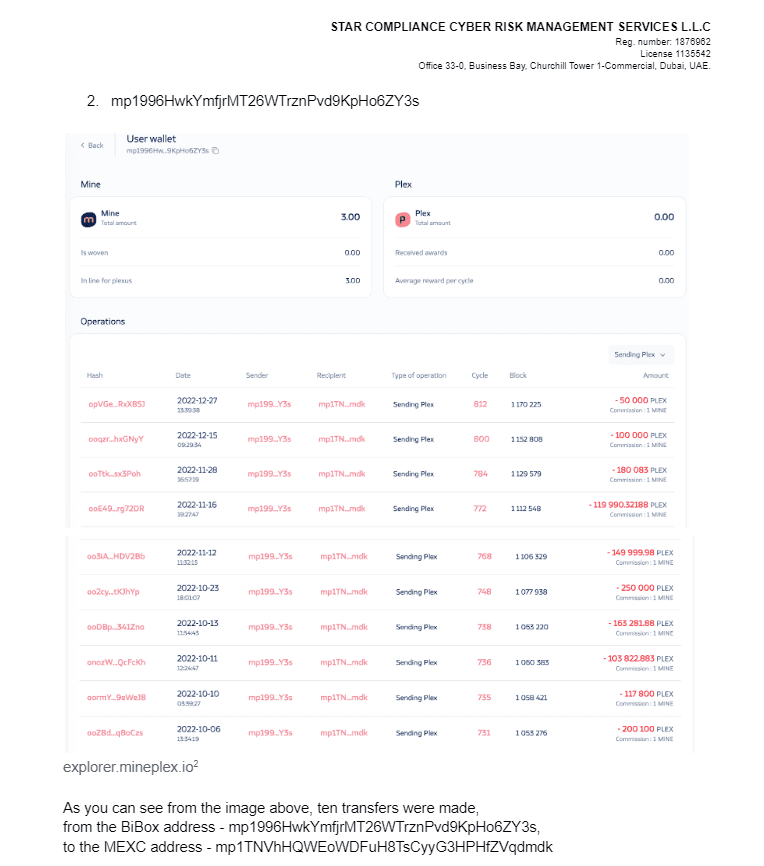

Mineplex team noted that the main balance of tokens stored on Bibox exchange began to rapidly flow to MEXC and Bybit conducted an internal investigation and concluded that tokens are moved from deposit addresses by management directly, rather than by major holders or ordinary users. Token developers demanded an explanation through an internal channel with the exchange, but top management made no comment.

The Mineplex team then turned to StarCompliance for an independent report. After reviewing the available data and gathering in one place, such as:

- Hashes;

- Addresses for deposits;

- Addresses where the funds were deposited;

- Quantity and value of the tokens at the exchange rate at the time of withdrawal;

- Fixing trades on the MEXC exchange;

- The volume of sales that continually put pressure on the PLEX price;

It was found that 2,900,000 to 5,000,000 PLEX tokens were withdrawn from the deposit wallets of the Bibox exchange, with a minimum loss of $3 million.

StarCompliance.io AML Report

The data, such as exchange addresses, specific transactions as in the screenshots, and hashes, are taken from a report from the Star Compliance team of experts.

However, the actual amount of damage remains unknown, and it is likely to be estimated in the tens of millions of dollars. This is because there are users who have not contacted the Mineplex team directly, whose efforts to develop the project have been wasted. In addition, there are holders and community members of the project, who lost 94% of the face value of the coin due to the sale of the token by the management of the Bibox exchange. We should not forget about the reputational damage caused to the entire project.

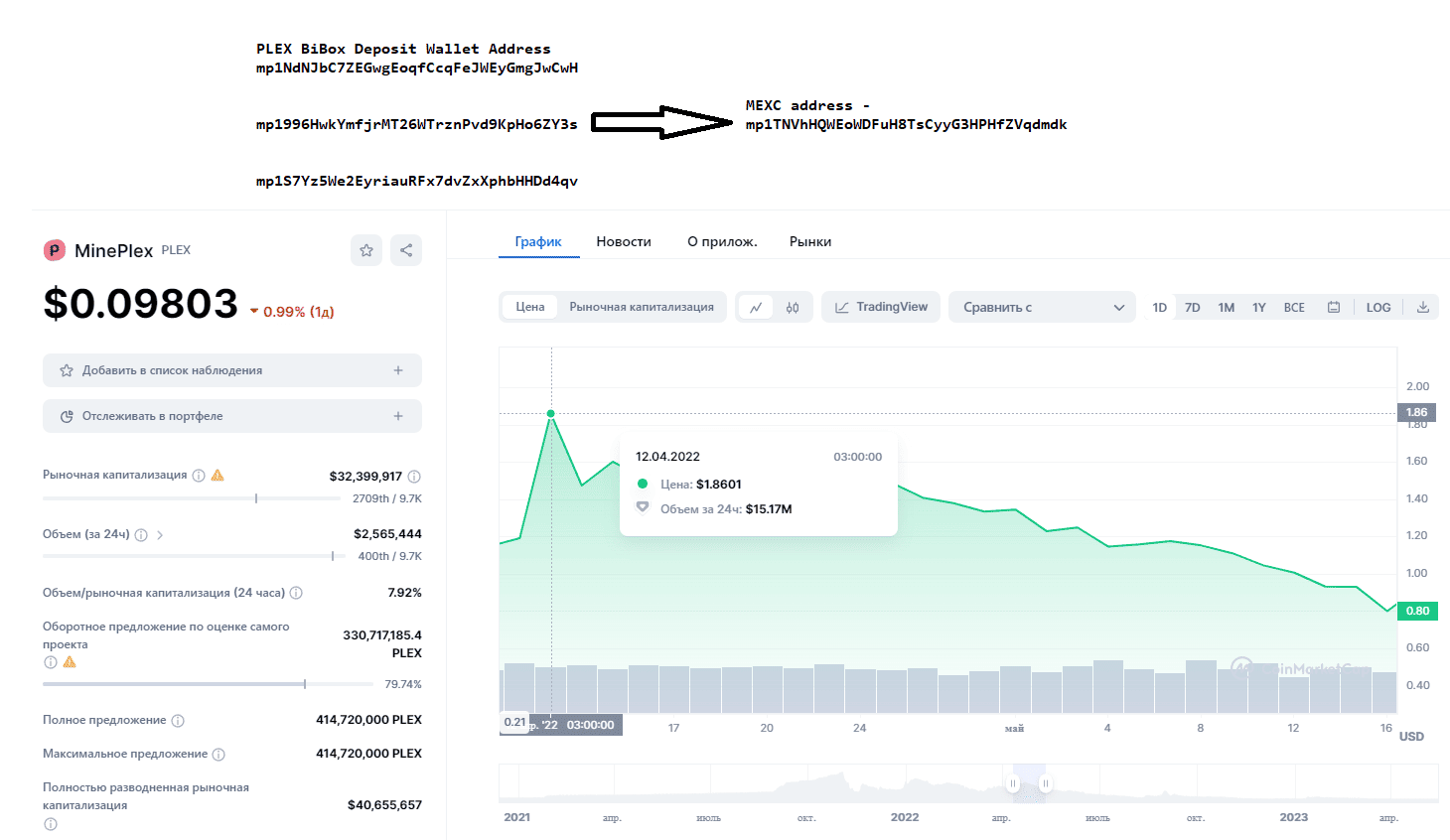

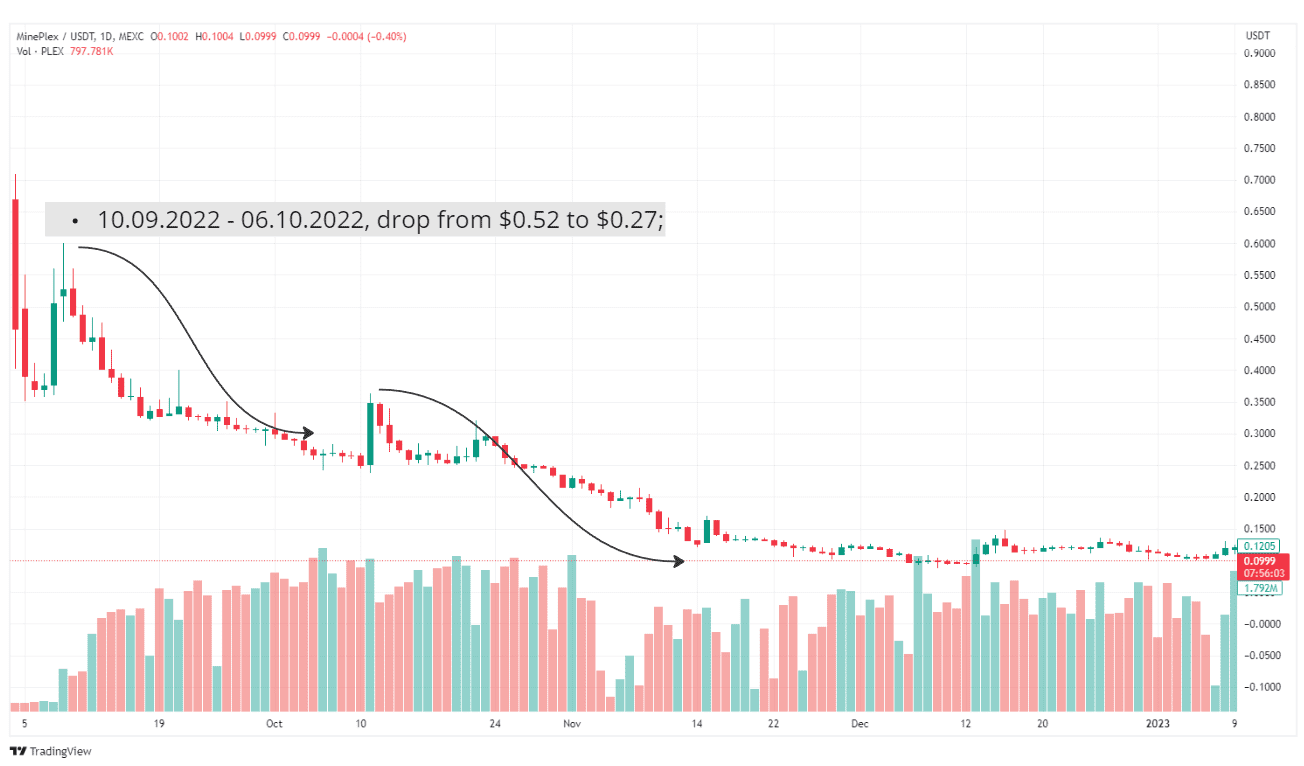

The period of a sudden “break” of Bibox communication with users who could not withdraw their tokens, as well as the Mineplex project team correspond to withdrawals to MEXC exchange addresses and the rapid fall of Plex token price, namely:

- 10.09.2022 – 06.10.2022, down from $0.52 to $0.27;

- 06.10.2022 – 07.01.2023, down from $0.27 to $0.11 per token.

Until 07/01/2023 there was a sharp decline in value from $1.86 to $0.11 per Plex.

https://coinmarketcap.com/ru/currencies/mineplex/

Since the first transfer from the Bibox exchange to the MEXC exchange, the token price has fallen by 57% in just one month of active sales.

Tradingview.com

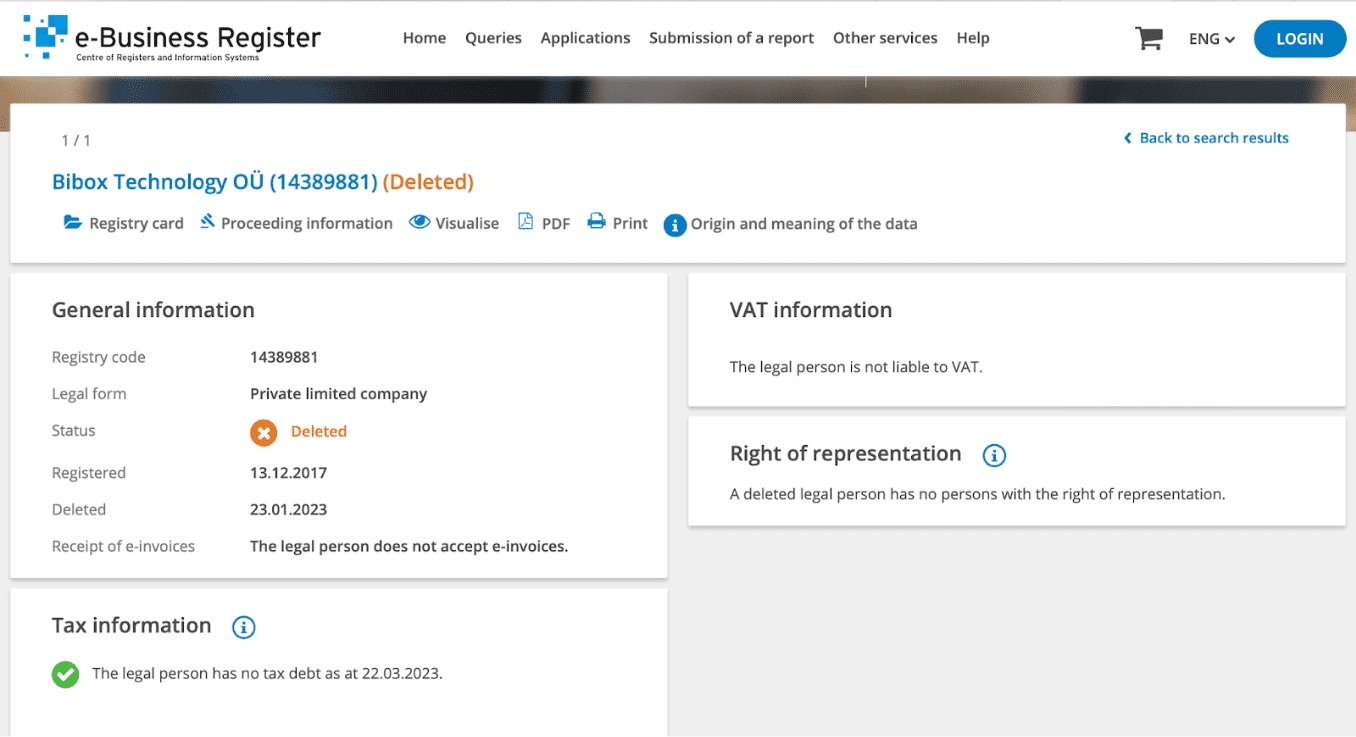

The consequences of the sale for Bibox: the prospects of liquidating the company through the courts

The exchange, covering many registrations during its operation, has spread to various countries, including Switzerland, the British Virgin Islands, Singapore and the United Kingdom. However, at the moment, it has no active companies and has had to close its branches around the world. In particular, the company has been completely liquidated in Estonia.

https://www.inforegister.ee/en/14389881-BIBOX-TECHNOLOGY-OU

In addition, the management of the exchange has been the subject of multiple lawsuits from disgruntled traders and users around the world.

Clifford v. Bibox Group Holdings Limited

In April 2020, Bibox Group Holdings Limited became a defendant in a class action lawsuit. According to 11 lawsuits filed in New York federal court, in which investors filed multiple proposed securities class actions for offering and selling billions of dollars worth of unregistered tokens.

Case Clifford v. Bibox Group Holdings Ltd. et al, Case Number 1:20-cv-02807

Bibox faced allegations that it failed to register as an exchange or broker-dealer and sold its own digital token without registering it as a security, then sold at least five other unregistered securities on its exchange. The complaint filed six federal securities law claims and about 150 claims that Bibox violated state securities laws by failing to register with state authorities.The lawsuit was filed on April 3, 2020, in the Southern District Court of New York.

https://business.cch.com/srd/InReBiboxGroupHoldingsLtdSecuritiesLitigation.pdf

The case of Mineplex vs. Bibox

In this case, the situation is no exception, and StarCompliance’s legal team is currently working with Mineplex, independent experts and affected PLEX token holders to file a class action lawsuit in order to achieve a fair resolution through the courts and a clear signal that such actions will not go unpunished.

Conclusion

In light of the provided evidence of the movement of PLEX tokens, it is undeniably clear that the actions performed by Bibox’s management can be qualified as dishonest. However, if you add to this the heavy reputational baggage that inevitably haunts the Bibox exchange, it becomes clear that the top management and the management of this platform are not known for their high moral principles. The StarCompliance litigation team, together with Mineplex, strongly discourages the use of this exchange. We, from our side, promise to use all legal tools to fight for safety, transparency, responsibility and protection of users’ interests in the world of cryptocurrency.